When we entered 2023, there was widespread discussion surrounding a potential recession that could precipitate a downturn in the housing market. Certain media outlets went as far as predicting a 10-20% decrease in home prices, perhaps leaving you apprehensive about purchasing a home.

However, the reality unfolded quite differently: home prices experienced an unexpected surge. Brian D. Luke, the Head of Commodities at S&P Dow Jones Indices, provides insight into this phenomenon:

“Looking back at the year, 2023 appears to have exceeded average annual home price gains over the past 35 years.”

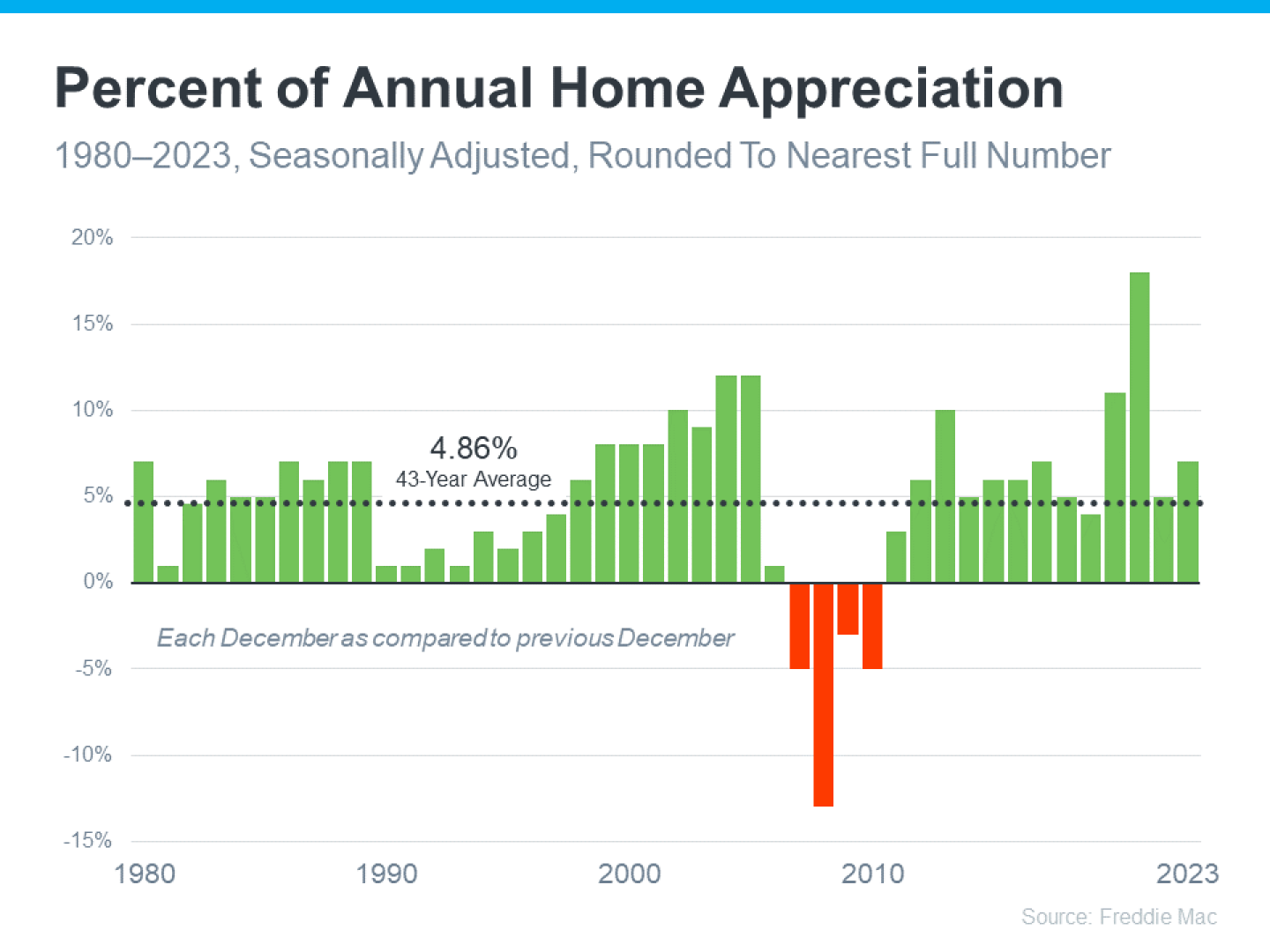

To put last year’s growth into context, the graph below uses data from Freddie Mac on how home prices have changed each year going back to 1980. The dotted line shows the long-term average for appreciation:

Since 1980, home prices have only experienced a decline during the housing market crash, highlighted in red on the graph above. Thankfully, the current market landscape differs significantly from that of 2008. Firstly, there is a scarcity of available homes to satisfy current buyer demand. Moreover, homeowners possess substantial equity, placing them in a much more secure position compared to the past. This mitigates the likelihood of a foreclosure surge that could drive prices down.

The consistent appreciation of home values, barring the highlighted periods of decline, underscores the wisdom in homeownership. By owning a home, you possess an asset that typically appreciates over time, thereby enhancing your net worth.

Therefore, if you are financially stable and equipped to handle the responsibilities and expenses associated with owning a home, it may be a prudent decision for you.

In essence, home prices tend to appreciate over time, making homeownership a sensible choice for those who are prepared. Consider consulting a local real estate agent to discuss your objectives and the available options in your area.