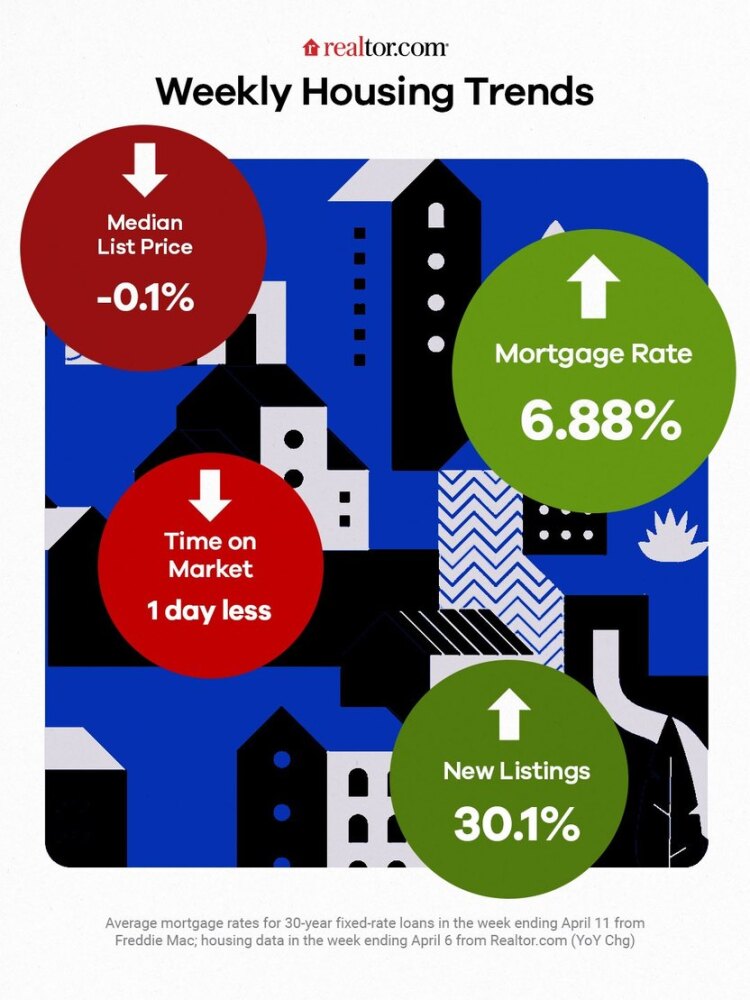

This week saw a significant increase in mortgage rates, prompting concern among homebuyers navigating the bustling spring housing market. According to Freddie Mac, the average rate for a 30-year fixed home loan climbed from 6.82% to 6.88% for the week ending April 11.

“Mortgage rates have been drifting higher for most of the year due to sustained inflation and the re-evaluation of the Federal Reserve’s monetary policy path,”

Sam Khater, Freddie Mac’s chief economist, said in a statement.

Even as mortgage rates continued their fluctuation, home sellers were forging ahead for the week ending April 6th.

“This spring, many sellers are actively listing their homes, with the number of newly listed homes up by 30.1% from a year ago,”

says Realtor.com® economist Jiaya Xu in her most recent analysis.

Here’s what else homebuyers and sellers need to know about the latest real estate data in this latest installment of “How’s the Housing Market This Week?”

Mortgage rates and ‘sticky inflation’Over the past few months, mortgage rates have experienced minimal changes, staying within the range of 6.6% to 7%. These rates are expected to stay elevated until there is noticeable progress in inflation towards the Federal Reserve’s target of 2%. |

“Sticky inflation and robust labor markets suggest that a Federal Reserve rate cut is unlikely to occur soon,”

says Xu.

High mortgage rates aren’t good news for anyone hoping to make moves in the housing market this spring.

“Eager buyers and sellers are hoping to see more favorable housing conditions as the spring selling season kicks off, however, mortgage rates have offered little relief.”

...says Realtor.com senior economic research analyst Hannah Jones.

As a result, some home shoppers may hold off, playing a wait-and-see game and banking on lower mortgage rates in the future.

To lure wary buyers, sellers are already slashing home prices as the housing supply swells, with the share of price reductions reaching 15% in March, tied with 2019 for the highest March share of price reductions since Realtor.com began tracking this data in 2017.

“Many sellers adjusted their expectations and proceeded with their selling plans, especially with the approach of the Best Time To Sell Week,” says Xu. This week, April 14–20, is “anticipated to provide the ideal balance of housing market conditions that favor home sellers more so than any other week in the year.”

Home prices experience a slight declineThe median list price saw a mere 0.1% decrease for the week ending April 6 compared to the same period last year. While this drop may seem insignificant, any indication of improved affordability in the current housing market is positive news for homebuyers. (Nationally, home prices remained at a median of $424,900 in March.) This slight dip in home prices also suggests a broader trend. As Xu explains...... | “This is the second week in a row where we saw negative annual price changes, and the third week of year-over-year price decline since July 2023.” |

Adding to the positive affordability trend, homes priced between $200,000 and $350,000 experienced a 30.5% annual increase in March, with the highest concentration of listings observed in the South.

The sudden increase in housing inventoryBuyers saw not only a boon of fresh listings for the week ending April 6, but also active inventory (a combination of new and old listings) up 30.4% above year-ago levels. The uptick marks 22 weeks where active listings registered above the same week a year ago. | “Buyers will find a broader selection of options available compared to last year,” says Xu. |

“However, even with recent improvements, the number of new homes for sale remains historically small.”

Indeed, the overall number of homes for sale for the week ending April 6 was down 37.9% compared with typical levels from 2017 to 2019.

Homebuyers are picking up the paceDespite the challenging mortgage rates, buyers are actively browsing listing pages, attending open houses, and submitting offers. For the week ending April 6, homes spent one day less on the market compared to the same period last year. In March, the median time homes spent on the market was 50 days. | “While inventory has grown notably compared to last year, homes are still selling relatively quickly, |

“More home options mean more buyers are finding what they are looking for, so homes continue to move relatively quickly.”